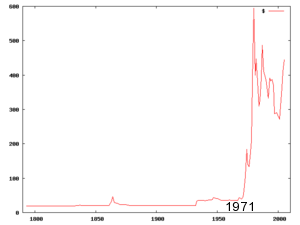

Up until 40 years ago all world currencies were pegged to the gold standard. It means anyone could take his money to a bank and come out with gold. As a consequence a country's central bank could only print money to the extent it had enough gold in reserve to back it up. But this all changed in 1971 when paper-money was deemed as trustworthy as gold.

Gold vs. Dollar

Was it a mistake? The recent trend of world economies is to "diversify away from US dollar investments". To put it another way, world economies are losing faith in the dollar because the US finances its trade imbalance by printing more and more bills. As goes the common saying "A tree does not grow to the sky" : printing more and more paper money does not increase worth forever and eventually the tall tree falls.

As world economies reduce their dollar reserves, gold is regaining favor as a safe bet. China and India, huge exporters and holders of US currency are both avid buyers of gold. There the ever-more affluent middle-class consumes a large portion of the gold market via jewellery. To some extend wealth flows away from the dollar into gold.

In China and India, gold is a keeper whereas dollars are not. Ultimately the two fastest growing economies may set the standard and history as to which asset will measure wealth and so far gold comes well ahead.